Apply For Navi Instant Personal Loans In India : Benefits, Eligibility Criteria, Documents Required

Apply For Instant Personal Loans In India: Benefits, Eligibility Criteria, Documents Required :

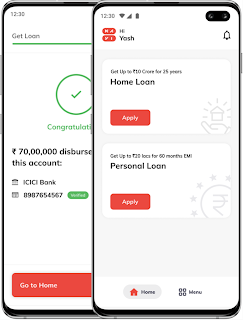

Navi Personal Loan Features :

👉 Get Navi instant personal loan up to Rs. 20 Lakh online.

👉 Processing fee is 3.99% to 6% (minimum Rs. 1,499 and maximum Rs. 7,499 + GST).

👉 Get the money instantly transferred to your bank account on approval.

👉 Instant online eligibility check.

👉 No bank statements or salary slips are required to apply for the loan.

👉 The entire process for Navi instant loan is 100% paperless.

👉 Minimal documentation required.

👉 No printouts of documents are required.

👉 Navi app loan interest rate is affordable and starts from 9.9% p.a. Flexible tenure up to 72 months and flexible EMI options available.

👉 No security deposit or collateral required to obtain the loan.

👉 Zero foreclosure charges levied on prepayment of the loan.

👉 Navi instant personal loan reviews are available online for your satisfaction and trust.

- Download the Navi App from the Play Store or App Store

- Once you have the application, you need to click on “Apply” tab

- Then you need to fill in basic details to process your loan application like

- Full Name

- Age

- Marital Status

- Pin code of residence

| Age | You should be between 18 and 65 years of age to avail the loan. The minimum age can also be increased to 21, 23 or 25 years in some cases |

| Interest Rate | Starting at 9.9% p.a. |

| Credit score | Your credit score should be at least 650 to apply for the loan. If your score is below 650, the loan application might get rejected |

| Employment | You should either be salaried or self-employed |

| Income Level | There is a minimum income which you should earn every month to qualify for the loan. The level varies across lenders |

Also Read : Axis Bank Credit Card Apply Online 2022

- Provides personal loan up to Rs 5,00,000 (five lakh).

- Instant money transfer to borrower’s bank account

- Account statement or salary slip is not mandatory

- 100% paperless loan application process

- Minimal documentation for loan application.

- No printouts are required.

- Easy repayment options.

- Instant loan-eligibility check.

- No security or guarantor is required.

Following are the key Navi loan app details :

| Minimum Loan Amount | Rs. 10,000 |

| Maximum Loan Amount | Rs. 20 Lakhs |

| Tenure | 3 to 72 months |

| Rate of Interest | 12% to 36% p.a. |

| Processing Fee | 3.99% to 6% of the loan amount |

| Collateral | Not required |

| Foreclosure Charges | Nil |