Loan & Credit Card

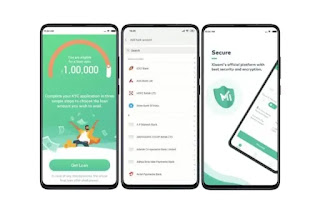

Mi Credit- Instant Loan App ( Mi Credit – Instant Personal Loan, Cash Online )

Mi Credit is the official loan app from Xiaomi – India’s #1 Smartphone Brand, offering loans up to ₹25,00,000 at low interest rates in the most convenient and secure way.

One can avail Personal, Business, and Gold loans in a quick and hassle-free manner.

Loan amount: From ₹5,000 to ₹25,00,000

Interest rates: From 10% to 36% per annum

Tenure: 91 days to 24 months

It offers service to users over 21 years old and allows you to apply for a loan in four quick steps and get money within minutes. The application process is completely digital and hassle-free, and can be completed with the help of your mobile phone anywhere, even when you are sitting at your home, office or commuting. You may use the loan funds for any personal or business requirements. You have the flexibility to choose EMI tenure, so that it is convenient for you to pay the EMIs !

Also Read : Digit General Insurance

Personal loan example:

Loan amount: ₹20,000

Tenure: 6 months

Interest rate: 16.2% per annum

Processing fee: ₹400 (2%)

GST on processing fee: ₹72

Total interest: ₹956

EMI: ₹3493

APR: 36%

Loan amount is ₹20,000. Disbursed amount is ₹19,528. Total loan repayment amount is ₹20,956.

Credit Report / Experian Score

In Mi Credit app, you can also check your credit report / Experian report worth ₹1,200 for free. You need to provide a few basic details and you can get a detailed analysis of your bureau report. You can use the tips to improve your credit score, which will be handy whenever you need a loan in future.

Product features

Xiaomi’s official loan app

Best security practices to keep your information safe and secure.

Best loan offers just for you

Loan amount up to ₹25,00,000. Interest rates starting at 10% per annum.

Quick approval process

Instant approval and direct money transfer to your bank account.

Also Read : Axis Bank Credit Card Apply Online 2022

Easy way to borrow

Simple documentation and 100% online process

How to apply for a loan?

Step 1: Install Mi Credit app from Google Play Store and register through Mi account or phone number

Step 2: Upload KYC documents (ID & Address Proof) & add personal details for online verification

Step 3: Add bank details to facilitate transactions

Step 4: Loan amount up to ₹25,00,000 is disbursed to your bank account quickly

Easy way to borrow

Simple documentation and 100% online process

How to apply for a loan?

Step 1: Install Mi Credit app from Google Play Store and register through Mi account or phone number

Step 2: Upload KYC documents (ID & Address Proof) & add personal details for online verification

Step 3: Add bank details to facilitate transactions

Step 4: Loan amount up to ₹25,00,000 is disbursed to your bank account quickly

Benefits of affording a Mi Credit Loan The method of applying for a Mi Credit loan is incredibly easy and hassle-free The lender disburses the loan amount directly to your bank account, once you meet the eligibility criteria. For availing Mi Credit Loan you can get amazing interest rate starting from 1.8% per month Mi Credit is secure and reliable which allows you to keep your personal information and loan credentials in a safe place

Also Read : TATA AIG INSURANCE

Also Read : TATA AIG INSURANCE

Related Queries :

mi credit personal loan,instant personal loan,mi credit loan apply,mi credit instant loan app download,mi credit loan,mi credit,mi credit instant personal loan,mi credit – instant personal loan cash online,instant loan,personal loan,mi credit loan application,mi credit app,mi credit instant loan,mi credit loan kaise le,instant personal loan online,mi credit loan interest rates,mi credit loan live proof,xiaomi mi credit loan,instant personal loan app